E-balance (GERMANY) in SAP Business ByDesign

29.12.2016

In Germany, companies are obliged by law to communicate their financial data to the authorities in electronic form (Section 5b of the Income Tax Act). This is done automatically via an electronic balance, called e-balance. Users in Business ByDesign have the option of generating such an e-balance in the system.

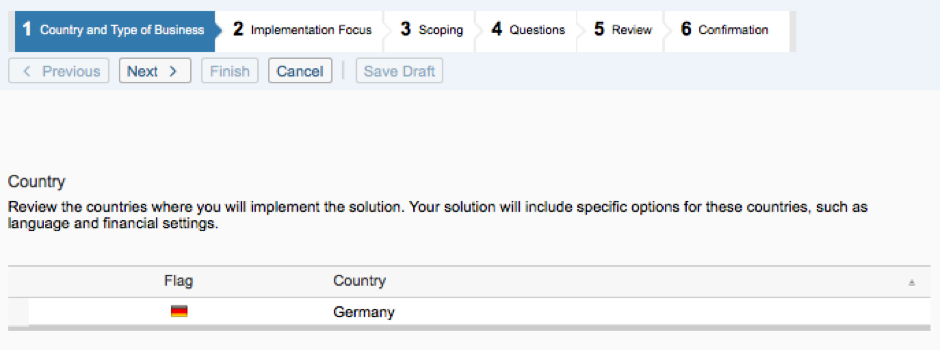

This option is only relevant for german companies. So you have to choose Germany as country in your scoping:

After selecting the right settings in the third and fourth step in scoping, you will find the task “E-Balance” in fine-tuning. In this task taxonomies are checked and imported. The reporting structures your companies require for transfer to the financial authorities are assigned to the selected taxonomies.

Taxonomies represent the structure on which the e-balance is based. This is specified by the Federal Ministry so that you can then add your company data. The taxonomies used in Germany are the GCD (Global Common Data Taxonomy) and the GAAP (Generally Accepted Accounting Principles Taxonomy). The GCD taxonomy contains master data about your company, which needs to be entered in a separate Excel template. The GAAP taxonomy contains definitions of the relevant business reporting data, such as balance, profit and loss accounting or cash flow statement.

Make sure you use the latest versions so that you can then assign your reporting structures to these.

Having made all preparations in the scoping and fine-tuning beforehand, you can create the e-balance. For this, open the “E-balance Germany” in the “General Ledger” Work Center and start a new e-balance run. This run extracts the required business and financial data as a file.

Back to overview